A Golden Opportunity To Buy Real Estate Is Upon Us

Back in 2017, I had a very difficult decision to make. My rowdy tenants gave notice and I had to decide whether to sell my rental property or try and find new tenants.

The house had been rented between 2014 – 2017 for $8,200 – $8,800 a month. But when I went to find new tenants at a similar rent in 2017, none were to be found. Instead, I got a couple of offers for only $7,500 a month after 45 days of looking.

Because my tenant situation gave me stress and my son was just born, I really felt that 2017 was a good time to sell. Further, I was running up against the $500,000 tax-free profit exclusion limit.

Earlier, in 2012, I had tried to sell the house for $1.7 million and received zero offers. My agent at the time told me one couple was looking to lowball me at $1.5 million and I told them don’t bother. Fast forward five years, I was able to find my one and only offer for $2.75 million so I took it.

After paying fees, taxes, and the $800,000 mortgage, I was left with about $1,800,000 in proceeds. Over the next 60 days, I invested $600,000 into dividend-paying stocks, $600,000 into CA municipal bonds, $550,000 into real estate crowdfunding, and left ~$50,000 in cash.

So far, the reinvested proceeds have done well. But most of all, the reinvested proceeds have provided a greater amount of passive income with minimal work on my part. I’m extremely thankful I was able to free up time since mid-2017 to be a stay at home dad.

I’m also thankful to the FS community for sharing their thoughts about whether or not to sell back in 2017. After over 1,000 votes, 75% of you said sell, which gave me added confidence to let my once beloved property go.

In this post, I will argue that a golden opportunity to buy real estate is once again upon us. My spidey senses are telling me it’s time to buy at least one property before January 1, 2021.

After I finish telling you why I’m getting bullish on real estate, I’d love for those of you who are bearish to blow my arguments to smithereens.

Why It’s Time To Buy Property Again

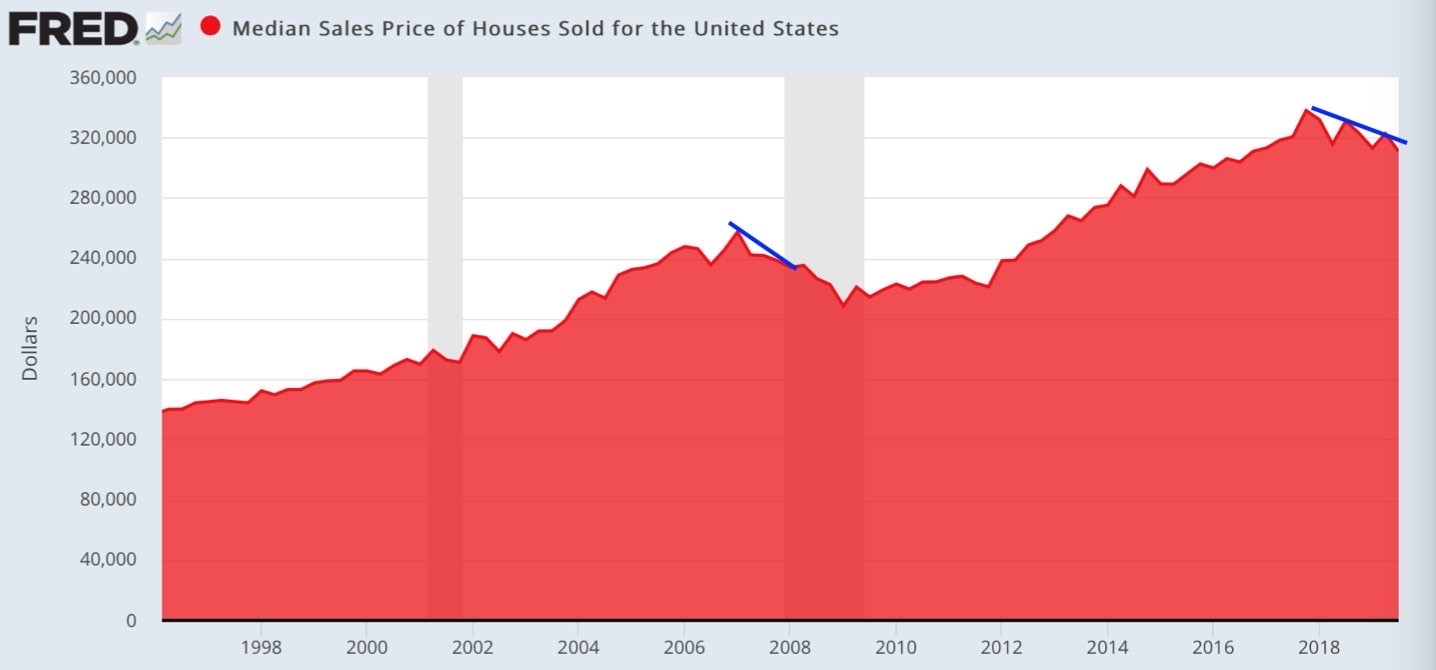

1) Prices have softened all across the country. It turns out, selling in 2017 looks to have been the recent median sales price peak according to the Federal Reserve Economic Data (FRED). See chart below.

If we look what happened after the previous peak in late 2006, we saw the median sales price go from $255,000 down to $210,000 (-17%) over the course of 2.5 years. Some time in 2H2009, home prices bottomed.

Home prices gradually ticked higher from late 2009 until 2012, before exploding ~55% higher from $220,000 to $340,000 in 2H2017.

The median sales price has since fallen from $340,000 to roughly $310,000 in 4Q2019, a 9% decline.

2) Mortgage rates have collapsed. Mortgage rates have declined by over 1% across various mortgage types since their highs in 2018. Although the average mortgage rate for a 30-year fixed is 3.49% and 3.25% for a 5/1 ARM according to Freddie Mac below, if you employ my mortgage rate strategies, you can do better.

I refinanced to a no-cost, 7/1 ARM at 2.625%, which is going to save me over $1,000 a month in cash flow until 2027. With hundreds of thousands of homeowners wisely refinancing their mortgages in 2H2019, more money will be spent to help prop up the economy.